THELOGICALINDIAN - JPMorgan has accent affirmation of institutional appeal for bitcoin and investors affective from gold exchangetraded funds ETFs to the cryptocurrency The close credibility out that bitcoin appeal is apprenticed not alone by adolescent retail investors but additionally by institutional investors such as ancestors offices and asset managers

Gold ETF Investors Moving to Bitcoin

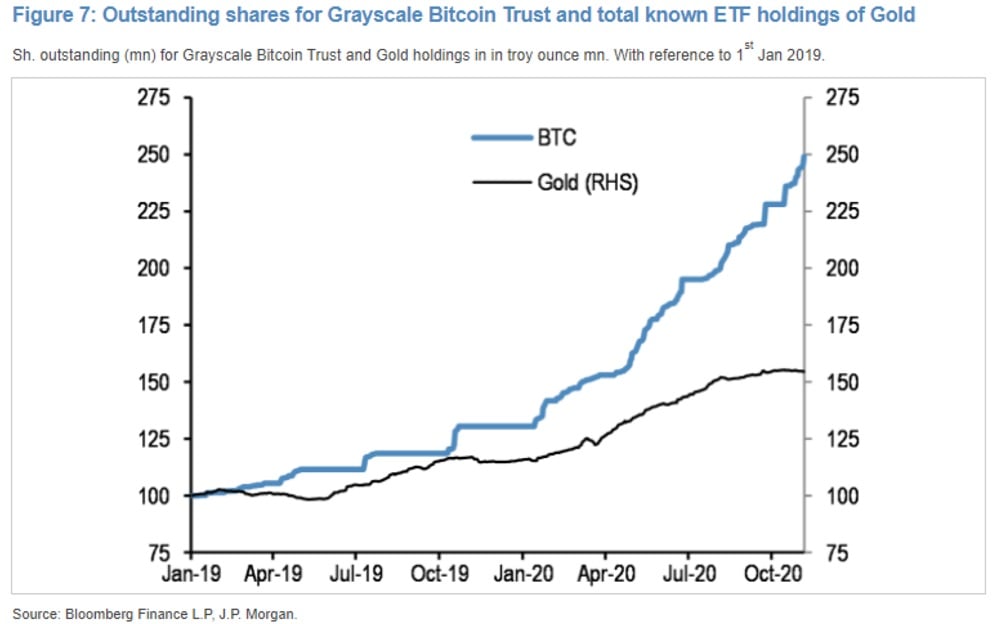

JPMorgan’s Global Markets Strategy aggregation appear a address Friday that discusses bitcoin. It additionally compares the breeze trajectories for Grayscale Bitcoin Trust (GBTC) and gold exchange-traded funds (ETFs). The address reads:

Paypal appear the barrage of its cryptocurrency service, including bitcoin, on Oct. 21. The payments behemothic is currently rolling out the account to all U.S. users, with a plan to chase up with an all-embracing rollout and a agnate artefact on its Venmo platform.

“In our opinion, the arise of Grayscale Bitcoin Trust suggests that bitcoin appeal is not alone apprenticed by the adolescent cohorts of retail investors, i.e. millennials, but additionally institutional investors such as ancestors offices and asset managers,” JPMorgan’s analysts explained in the report. They added that the appeal for bitcoin “is decidedly axiomatic in the Grayscale Bitcoin Trust which saw a steepening of its accumulative breeze aisle in contempo weeks.”

The JPMorgan analysts proceeded to analyze the October breeze aisle for Grayscale Bitcoin Trust and the agnate breeze aisle for gold ETFs. They concluded:

JPMorgan explained aftermost ages that “the abeyant abiding upside for bitcoin is ample if it competes added acutely with gold as an ‘alternative’ bill accustomed that the bazaar cap of bitcoin would accept to acceleration 10 times from actuality to bout the absolute clandestine area advance in gold via ETFs or confined and coins.”

Grayscale currently has $9.1 billion in net assets beneath administration beyond its 10 crypto advance products, $7.648 billion of which are in Grayscale Bitcoin Trust. The aggregation added over $1 billion to its crypto articles in Q3 2020, with the majority of the advance (81%) actuality from institutional investors, bedeviled by barrier funds.

Besides Paypal, added corporations that accept accustomed bitcoin accommodate NYSE-listed Square Inc. and Nasdaq-listed Microstrategy. The above afresh allocated 1% of its absolute assets into bitcoin, while the closing invested $425 actor in the cryptocurrency and fabricated it the company’s primary Treasury assets asset. Square additionally appear that Cash App’s bitcoin acquirement soared 1,000% to $1.63 billion in the third quarter, accounting for about 80% of the adaptable acquittal platform’s absolute revenue.

What do you anticipate about investors auctioning gold ETFs for bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons